Featured

Table of Contents

Which one you select relies on your requirements and whether the insurance company will accept it. Policies can additionally last till specified ages, which most of the times are 65. As a result of the many terms it uses, level life insurance coverage provides potential insurance policy holders with versatile alternatives. But past this surface-level info, having a better understanding of what these plans require will assist guarantee you purchase a plan that fulfills your requirements.

Be mindful that the term you select will influence the premiums you spend for the plan. A 10-year degree term life insurance coverage policy will certainly set you back less than a 30-year plan due to the fact that there's less chance of an event while the strategy is active. Reduced threat for the insurance firm equates to reduce premiums for the insurance policy holder.

Your family members's age need to additionally influence your policy term selection. If you have little ones, a longer term makes sense because it protects them for a longer time. If your kids are near the adult years and will be financially independent in the near future, a shorter term may be a far better fit for you than a lengthy one.

When comparing entire life insurance policy vs. term life insurance coverage, it deserves noting that the latter generally costs less than the previous. The outcome is extra insurance coverage with lower costs, providing the finest of both worlds if you need a significant quantity of protection yet can not pay for a much more costly plan.

What is the Difference with Term Life Insurance?

A level death advantage for a term plan usually pays as a round figure. When that takes place, your beneficiaries will get the entire amount in a single settlement, and that amount is not thought about income by the IRS. For that reason, those life insurance coverage proceeds aren't taxable. Nevertheless, some level term life insurance policy business enable fixed-period repayments.

Rate of interest settlements got from life insurance coverage plans are considered earnings and are subject to taxes. When your degree term life plan runs out, a couple of different points can take place. Some coverage terminates promptly without any alternative for revival. In other circumstances, you can pay to expand the strategy past its initial date or transform it right into a permanent policy.

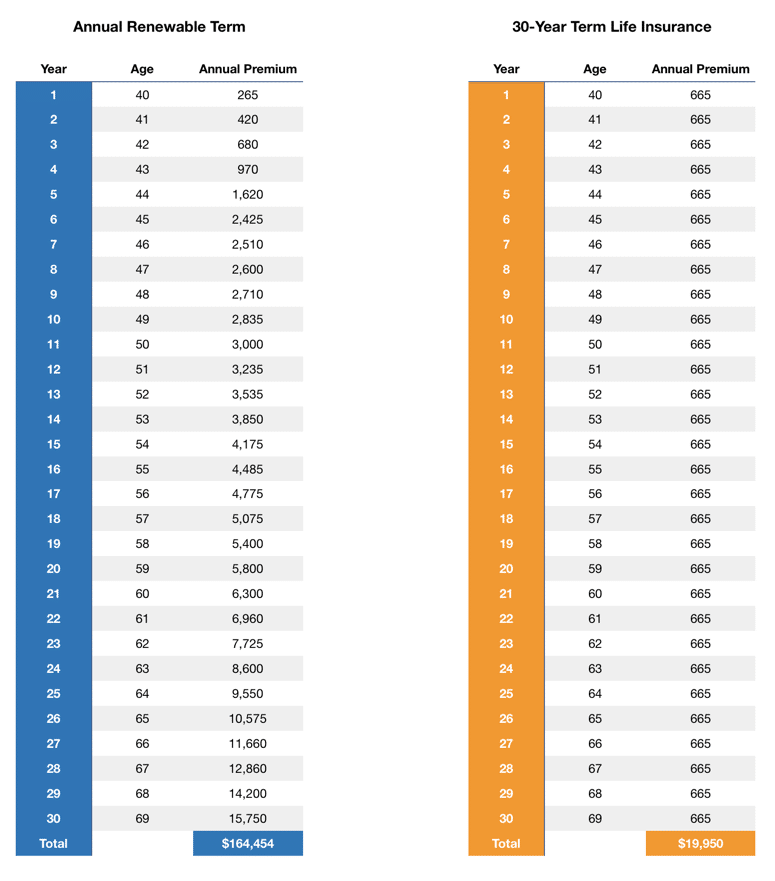

The disadvantage is that your renewable degree term life insurance policy will certainly come with greater premiums after its preliminary expiration. Advertisements by Cash.

Life insurance policy companies have a formula for calculating danger utilizing death and interest (Term life insurance level term). Insurance providers have countless clients taking out term life plans at once and utilize the premiums from its energetic plans to pay enduring recipients of various other plans. These business use mortality to estimate the number of individuals within a certain team will submit fatality insurance claims annually, which info is used to determine typical life spans for possible policyholders

Furthermore, insurance coverage business can invest the cash they receive from premiums and enhance their earnings. Given that a level term plan doesn't have money value, as an insurance policy holder, you can't spend these funds and they don't offer retired life income for you as they can with whole life insurance policy policies. The insurance coverage business can invest the money and gain returns.

The list below area information the pros and disadvantages of degree term life insurance. Foreseeable costs and life insurance policy protection Simplified policy framework Prospective for conversion to long-term life insurance policy Minimal insurance coverage period No money worth build-up Life insurance policy premiums can boost after the term You'll find clear benefits when comparing degree term life insurance to other insurance policy kinds.

What is Level Term Life Insurance? Explained Simply

You constantly understand what to anticipate with low-cost degree term life insurance policy coverage. From the minute you obtain a plan, your premiums will certainly never ever change, aiding you prepare monetarily. Your insurance coverage won't differ either, making these policies efficient for estate preparation. If you value predictability of your payments and the payouts your heirs will receive, this sort of insurance can be a great suitable for you.

If you go this course, your costs will certainly boost however it's always good to have some adaptability if you desire to maintain an energetic life insurance coverage policy. Renewable level term life insurance is another choice worth taking into consideration. These policies enable you to maintain your present strategy after expiry, offering adaptability in the future.

What is Term Life Insurance With Accidental Death Benefit? Explained in Simple Terms?

You'll choose a coverage term with the finest level term life insurance coverage prices, however you'll no much longer have coverage once the strategy ends. This drawback can leave you rushing to locate a new life insurance coverage policy in your later years, or paying a premium to prolong your existing one.

Many whole, global and variable life insurance policy policies have a money value part. With among those policies, the insurance company deposits a section of your month-to-month premium repayments into a money worth account. This account makes rate of interest or is spent, aiding it expand and give an extra considerable payment for your recipients.

With a degree term life insurance policy policy, this is not the instance as there is no cash worth component. Because of this, your policy will not grow, and your survivor benefit will never raise, thereby limiting the payment your recipients will receive. If you want a plan that offers a fatality benefit and develops cash worth, check into whole, global or variable plans.

The second your plan runs out, you'll no much longer have life insurance policy coverage. Degree term and decreasing life insurance offer similar policies, with the major distinction being the death advantage.

It's a kind of cover you have for a specific amount of time, called term life insurance policy. If you were to die during the time you're covered for (the term), your enjoyed ones get a set payout agreed when you obtain the plan. You just pick the term and the cover amount which you might base, for example, on the expense of increasing youngsters up until they leave home and you might utilize the settlement in the direction of: Assisting to repay your home mortgage, financial obligations, charge card or lendings Helping to spend for your funeral expenses Helping to pay college costs or wedding celebration expenses for your youngsters Aiding to pay living prices, replacing your income.

All About Level Premium Term Life Insurance Policies Coverage

The plan has no cash worth so if your payments stop, so does your cover. If you take out a degree term life insurance policy you could: Choose a taken care of amount of 250,000 over a 25-year term.

Table of Contents

Latest Posts

Burial Insurance Pro

No Exam Instant Life Insurance

Compare Funeral Cover

More

Latest Posts

Burial Insurance Pro

No Exam Instant Life Insurance

Compare Funeral Cover